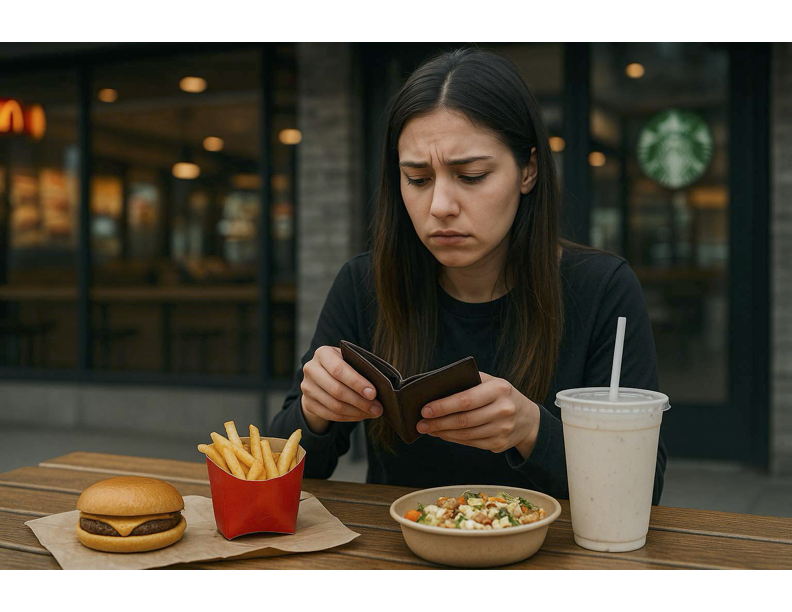

Restaurant chains are facing a shift that could shake up the industry: younger consumers are cutting back on their spending.

Recent reports from major chains like McDonald’s, Starbucks, and Chipotle reveal that Gen Z and younger millennials aren’t eating out as often or spending as much. This isn't just a blip — it’s a trend that’s starting to impact bottom lines.

What’s Driving the Cutback?

-

Rising Costs, Tighter Budgets

Inflation isn’t just a headline. It’s showing up in everyday decisions. Rent, groceries, and student loan payments are eating into disposable income. For many younger consumers, paying $15 for a fast-casual meal isn’t worth it anymore. -

Value Disconnect

Chains have steadily raised prices over the past few years. But younger diners aren’t seeing enough value in return. A $7 coffee or a $12 burger doesn't hit the same when the quality or experience hasn’t improved. -

Changing Habits

Younger generations are cooking at home more, using meal kits or opting for cheaper grocery store options. Many are also health-conscious and less drawn to the heavily processed menus that dominate chain restaurants. -

Digital-First Expectations

Clunky apps, bad loyalty programs, and slow mobile ordering can drive younger users away. They expect seamless digital experiences — and if they don’t get them, they bounce.

The Industry's Wake-Up Call

Restaurant chains are starting to feel the pressure. Some are pivoting with value menus, improved tech, or healthier offerings. But others are still lagging, relying on brand recognition and legacy models that don’t resonate like they used to.

Younger consumers aren't anti-restaurant. They’re just more selective. To win them back, chains will need to prove they’re worth the spend — through quality, transparency, pricing, and better digital engagement.

This isn’t about short-term deals. It’s about long-term relevance.